BitGo Eyes US IPO After 4x Revenue Surge in Early 2025

TL;DR Breakdown

- BitGo filed for a US IPO after reporting $4.19 billion in revenue in the first half of 2025.

- The crypto custodian’s profitability declined as costs escalated while diversifying for institutional clients.

- Goldman Sachs and Citigroup will underwrite the deal as crypto IPOs fuel a strong US listing market.

BitGo, a major digital asset custodian in the United States, has registered an initial public offering (IPO) with the U.S. Securities and Exchange Commission (SEC). The California-based company, which was established in 2013, registered its S-1 and will be listed on the New York Stock Exchange under the symbol BTGO. The filing comes after the company reported $4.19 billion in revenue in the first half of 2025.

Despite the surge, profitability trended in the reverse direction. Net income fell to $12.6 million from $30.9 million in 2024, indicating increases in costs associated with the growth of operations for institutional clients. According to analysts, the pressure stems from expansion efforts as demand for secure storage of digital assets increases.

BitGo was launched in 2013 and is now one of the largest custodians in the US. The company holds over $90 billion in assets in 1,400 supported tokens and serves 4,600 institutional clients. Its latest valuation was $1.75 billion in a funding round in 2023.

Wall Street Banks Join Push to Underwrite Digital Asset Listings

According to its filing, BitGo intends to trade on the New York Stock Exchange under the ticker “BTGO.” Goldman Sachs and Citigroup will lead the underwriting, underlining the growing involvement of Wall Street in digital asset infrastructure. Co-founder and chief executive Michael Belshe will maintain control over key shareholder issues.

The move comes just days after Gemini’s debut on Nasdaq and follows a year of activity from crypto firms entering public markets. Circle, Figure, and Bullish have all released successful offerings in 2025, and several have shown good early demand. Their performance has fueled investor appetite for stocks related to providing blockchain services, which are now seen as part of mainstream portfolios.

Crypto IPOs are changing the script of equity markets dominated by technology and health care debuts. Investment banks are also responding to this trend, strengthening relationships with digital asset companies either through underwriting or direct exposure.

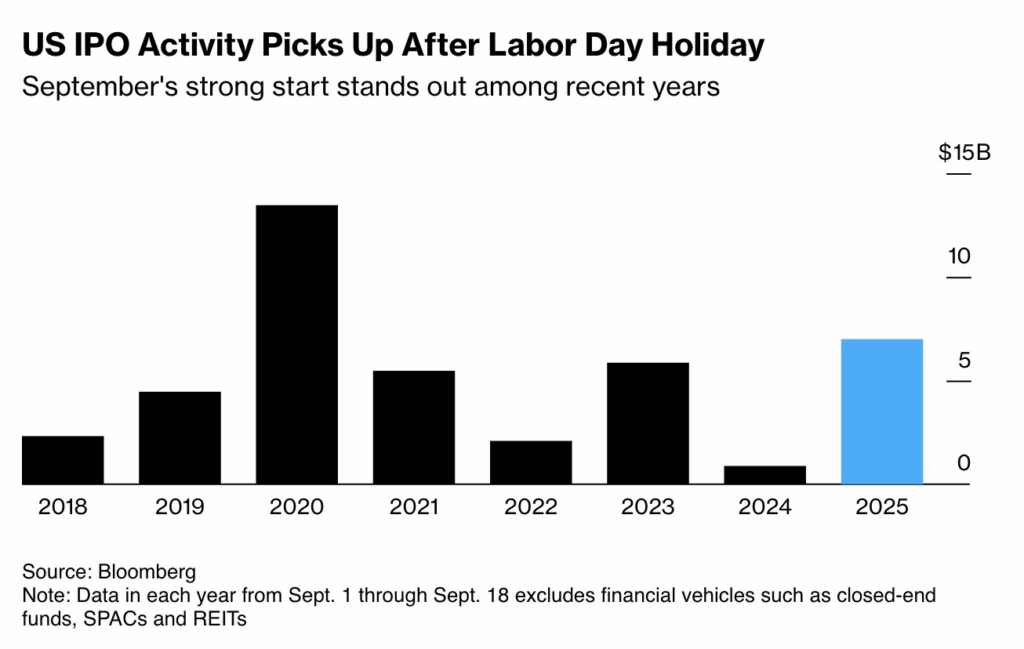

Broader IPO Market Benefits from Fed Policy Shift

BitGo’s filing comes as U.S. IPO activity has recovered. Bloomberg reported that 14 companies went public in the month of October alone, raising more than $7 billion, the busiest month since 2020. The rebound comes after a Federal Reserve rate cut, which analysts say has opened up liquidity and boosted investor appetite for new equity issuances.

Circle’s stock has been one of the best performers within cryptocurrencies, surging 365% over its IPO cost after a $1.2 billion raise in June. While not all recent debuts have retained their early edge, the concentration of listings highlights the rising influence of digital asset companies in driving IPO energy.

Additionally, BitGo recently secured an extension of its license from the Federal Financial Supervisory Authority (BaFin) of Germany. The approval enables the company to offer more of its crypto services to European investors.

According to the company, its subsidiary BitGo Europe is now authorized to offer custody, staking, transfer, and trading services. Institutional clients will also have access to an over-the-counter (OTC) trading desk and a number of liquidity venues.

Regulatory clarity in Washington and approval of crypto exchange-traded funds have also led to less uncertainty for investors. With billions of dollars now pouring into digital assets via ETFs, companies like BitGo are sitting at the center of a market that institutions are starting to treat as a regular asset class.