BNB surges to $1,000 all-Time High as Binance Nears DOJ Deal

TL:DR Breakdown

BNB hit a record high of $1,005.29 with daily trading volume surging to $4.17 billion.

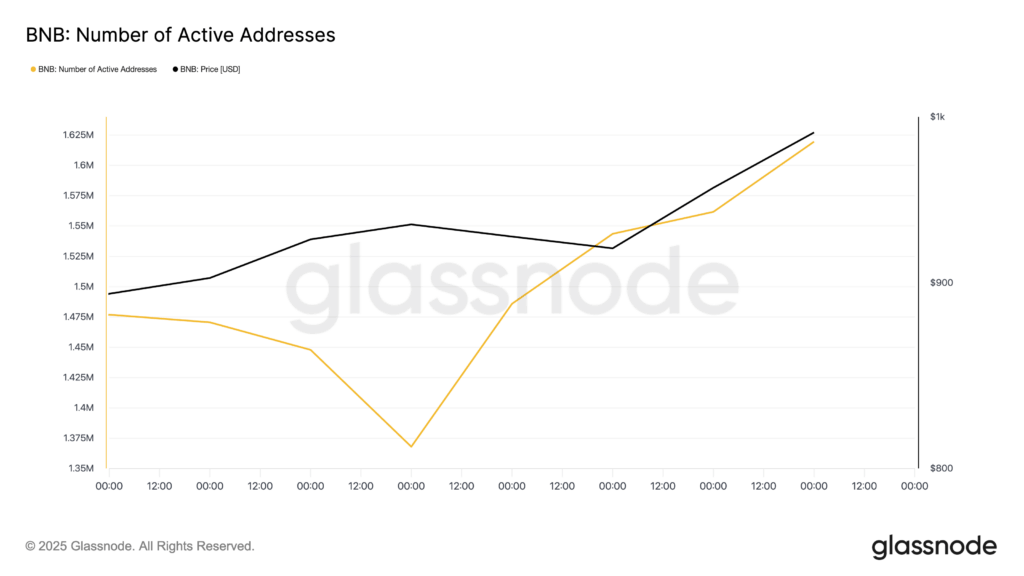

On-chain activity also increased, with the number of unique addresses increasing 10% and futures open interest reaching $1.96 billion.

Binance’s talk with the DOJ and rumours surrounding Zhao’s return boosted sentiment.

BNB Chain’s native token, BNB, has surged to a new historical peak of $1,005.29 for the first time since its launch. The move was driven by surging trading activity, with the volume surging to $4.17 billion, a 24% increase in 24-hour trading volume.

The rally brought the market capitalization of BNB to $139.92 billion, calculated from its 139.18 million circulating supply. Over the past year, the asset has surged by 97%, rising from $509.84 to its all-time high. BNB gains also helped it surpass Solana, reclaiming its fifth market cap position.

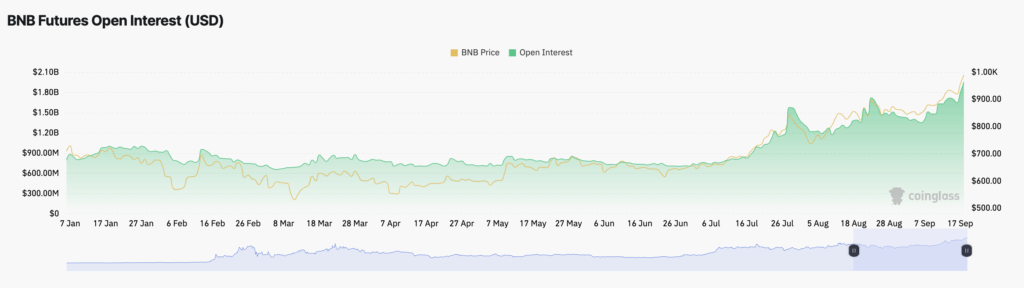

Derivatives Market Signals Confidence

BNB’s recent move was coupled with a parallel rise in trading volume with the price, showing high participation in the market rather than isolated speculative moves. On-chain data adds to the bullish look. According to Glassnode, active addresses on the BNB Chain have increased by 10% week-over-week, indicating growing adoption.

Futures activity has also been accelerating. Data from Coinglass shows that BNB’s future open interest increased by 9% in 24 hours to a record $1.96 billion. Rising open interest during a rally indicates that traders are entering new positions, adding depth and liquidity to the market. The steep increase in derivatives indicates that traders are making big bets on volatility.

Former Binance CEO Changpeng Zhao (CZ) commented on the milestone, recalling BNB’s rise from its $0.10 ICO in 2017 to today’s $1,000 peak. He noted , “Watching #BNB go from $0.10 ICO price 8 years ago to today’s $1000 is something words cannot explain. This is just the beginning. To the next 10000x together!”

Binance DOJ discussions speculation

The rally highlights renewed confidence in BNB as Binance is reportedly in discussions with the US Department of Justice to terminate a key compliance mandate associated with its 2023 settlement. The bank has operated under two separate compliance monitors since pleading guilty to anti-money laundering and sanctions violations, which involved paying $4.3 billion in fines.

Binance has been trying to smooth ties with US regulators. CZ, who served four months in prison as part of the 2023 settlement, said in May that he hoped for a pardon from President Trump. The exchange has also collaborated with the Trump family’s World Liberty Financial to launch a new stablecoin. Per reports, the platform wrote the basic code to power WLFI’s USD1. The reported negotiations come as regulators have softened their stance toward crypto under the administration of President Donald Trump.

BNB technical outlook

BNB started its surge at around $956 before soaring to $1,000. It consolidated between $983 and $988 before breaking the resistance near $995. The final push featured a quick market run from $998.74 to $1,004.28 in just six minutes, driven by trading volume surges.

The resistance has moved to $1,005, and support has moved to near $998. The support for the token’s ability to trade above $1,000 will likely dictate the token’s next move, where increased trading volume and network adoption can serve as firm fundamentals.